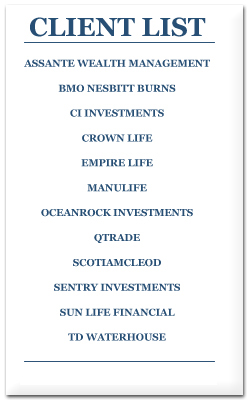

Whether you help people achieve their life goals or protect their loved ones, I have likely written about the products you offer.

I have extensive financial services experience, specializing in advisor and client materials for investments, financial planning and insurance.

Projects include fund commentaries, quarterly reports, sales presentations, product launches, brochures and one-pagers, client and advisor guides, website content, sales letters and newsletters.

Investments and Financial Planning

Areas of experience: Retirement planning, education funding, planned giving, tax and estate planning.

Investment products and plans: Mutual funds, exchange traded funds, corporate class funds, ethical funds, flow-through limited partnerships, guaranteed investment funds, universal life insurance, non-registered accounts, RRSPs, RESPs, TFSAs.

Concepts: I’ve written about a broad range of investment concepts, so I likely have experience in almost any project you need completed. Here’s just a small sampling to give you an idea: strategic vs. tactical asset allocation, dollar-cost averaging, income splitting, living and testamentary trusts, tax-advantaged retirement income, estate freezes, insured annuities.

Personal Insurance

Areas of experience: Life and health protection, income protection, tax-advantaged investing, planned giving, retirement income, estate planning.

Products for protection: Life, disability, critical illness and long-term care insurance.

Products for investments and income: Segregated funds, universal life insurance, annuities and insured annuities, guaranteed lifetime withdrawal benefit products.

Concepts: Disability vs. critical illness coverage, income protection, capital gains protection, estate preservation, intergenerational wealth transfer, estate equalization, RRIF/RRSP tax protection, retirement income for life, plus many more.

Business Insurance

Areas of experience: Business continuation, group benefits, split-dollar arrangements, retirement planning, business succession.

Products for protection: Life, disability and critical illness insurance.

Vehicles for investments and income: Universal life insurance, segregated funds, Individual Pension Plan (IPP), Retirement Compensation Arrangement (RCA), corporate insured retirement program.

Concepts: Key person protection, business overhead protection, insured buy-sell agreements, corporate-owned life insurance, group life and health benefits, estate freeze, tax management of corporate surplus, estate planning.